how to put instacart on taxes

The IRS establishes the deadlines for the payment. More posts from the.

Instacart Reviews 1 991 Reviews Of Instacart Com Sitejabber

Practically speaking however drivers will once in a while arrive at that 25 number.

. For Instacart to send you a 1099 you need to earn at least 600 in a calendar year. Irs free file site gives you access to the self employed version of turbo tax for free. After you total up all of the expenses for operating your car for the year you multiply the amount by the percentage of business use of your vehiclethe business miles for the year divided by the total miles for the year.

Weve put together some FAQs to help you learn more about 1099s and how to use Stripe Express to review your tax information and download your tax forms. At the beginning of next year you should have more than enough to pay and treat the rest as your tax refund. States without income tax include.

For Instacart to send you a 1099 you need to earn at least 600 in a calendar year. If you drive as a Lyft 1099 contractor for other rideshare apps or do other part-time gigs on the side. Missing quarterlydeadlines can mean accruing penalties and interest.

According to Glassdoor in-store Instacart shoppers earn an average of 13 per hour. As an Instacart shopper youll save 20 on TurboTax Self-Employed click here to learn more and. Your total miles are 20000.

The first step of the Instacart shopper taxes is to calculate your estimated taxes and proactively pay estimatedincome taxes on a quarterly basis. What percentage of my income should I set aside for taxes if Im a driver for Instacart. For example for the year.

Your 1099 tax form will be sent to you by January 31 2022 note. Pay Instacart Quarterly Taxes. I end up getting a refund.

The organization distributes no official information on temporary worker pay however they do publicize that drivers can make up to 25 every hour during occupied occasions. Most states but not all require residents to pay state income tax. Accurate time-based compensation for Instacart drivers is difficult to anticipate.

The SE tax is already included in your tax due or reduced your refund. When you file your taxes youll need to fill out Schedule C Schedule SE and your 1040 tax forms along with the information from your 1099. There is a 45 late fee plus interest for each month your tax return is late but only a 05 late fee for each month your payment is late.

If you have a W-2 job or another gig you combine your income into a single tax return. Reports how much money Instacart paid you throughout the year. Youll need your 1099 tax form to file your taxes.

Youll include the taxes on your Form 1040 due on April 15th. For instacart shoppers in edmonton north ab your taxes will not. This includes self-employment taxes and income taxes.

Instacart will file your 1099 tax form with the IRS and relevant state tax authorities. Stride Tip If you ever owe more taxes than you can afford and youre not able to pay your entire owed tax on time make sure to file your tax return anyway. We suggest you put a reminder on your phone.

I just put in the 1099 form once a year but I literally write off all my miles insurance internet car bill etc. Put 20 away for the just in case. Gig platforms dont withhold or take out taxes for you.

Stripe will email you instructions on how to set up a Stripe Express accountYoull need to create an account and agree to e-delivery ie agree to receive your 1099 tax form electronically via. Depending on your state youll likely owe 20-25 on your earnings from instacart. Learn the basic of filing your taxes as an independent contractor.

The SE tax is in addition to your regular income tax on the net profit. Instacart shoppers typically file personal tax returns by April 15th for the income you earned from January 1st to December 31st the prior year. Its pretty simple to file these yourself or you can pay someone to prepare them for you.

Your total auto expenses are 5000. W-9s are for independent contractor positions and tell Instacart your legal name address and tax identification number. For SE self employment tax - if you have a net profit after expenses of 400 or more you will pay 153 for 2017 SE Tax on 9235 of your net profit in.

If you choose to become an in-store shopper youll know ahead of time how much you can expect to make when you pick up a shift. Tax tips for Instacart Shoppers. Youll include the taxes on your form 1040 due on april 15th.

Paper forms delivered via mail may take up to an additional 10 business days. As an independent contractor you must pay taxes on your Instacart earnings. The tax rates can vary by state and income level.

Youll be getting a 1099 from Instacart in early 2021 for the 2020 tax year. Instacart contracts checkr inc to perform all shopper background checks. Be sure to file separate Schedule C forms for each separate freelance work that you do ie.

There are a few different taxes involved when you place an order. To actually file your Instacart taxes youll need the right tax form. With TurboTax Live youll be able to get unlimited advice from tax experts as you do your taxes or have everything done for you start to finish.

Depending on your location the delivery or service fee that you pay to Instacart in exchange for its service may also be subject to tax. The tax andor fees you pay on products purchased through the Instacart platform are calculated the same way as in a physical store. Up to 5 cash back Get unlimited year-round tax advice from real experts with TurboTax Live Self-Employed.

When you work for instacart youll get a 1099 tax form by the end of january. IRS deadline to file taxes. It is on the 1040 line 57.

As of December 2020 159 shoppers reported a range of earnings from 7 to 21 per hour. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year. And if you make money outside of Instacart your tax bracket will depend on your entire income not just from shopping for Instacart.

By early January 2022. Get more tips on how to file your taxes. First fill out Schedule C with the amount you made as indicated in Box 7 on your Instacart 1099.

How To Get Instacart Tax 1099 Forms Youtube

Grocery Delivery Firm Instacart Confidentially Files To Go Public Investing News Us News

Instacart Surges Past Walmart In Online Grocery Market

Instacart Driver Jobs In Canada What You Need To Know To Get Started

How To Fill Out Schedule C Grubhub Doordash Uber Eats Instacart Instacart Rideshare Grubhub

How To Add Your Pc Optimum Card To Your Instacart Account

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

Instacart Driver Jobs In Canada What You Need To Know To Get Started

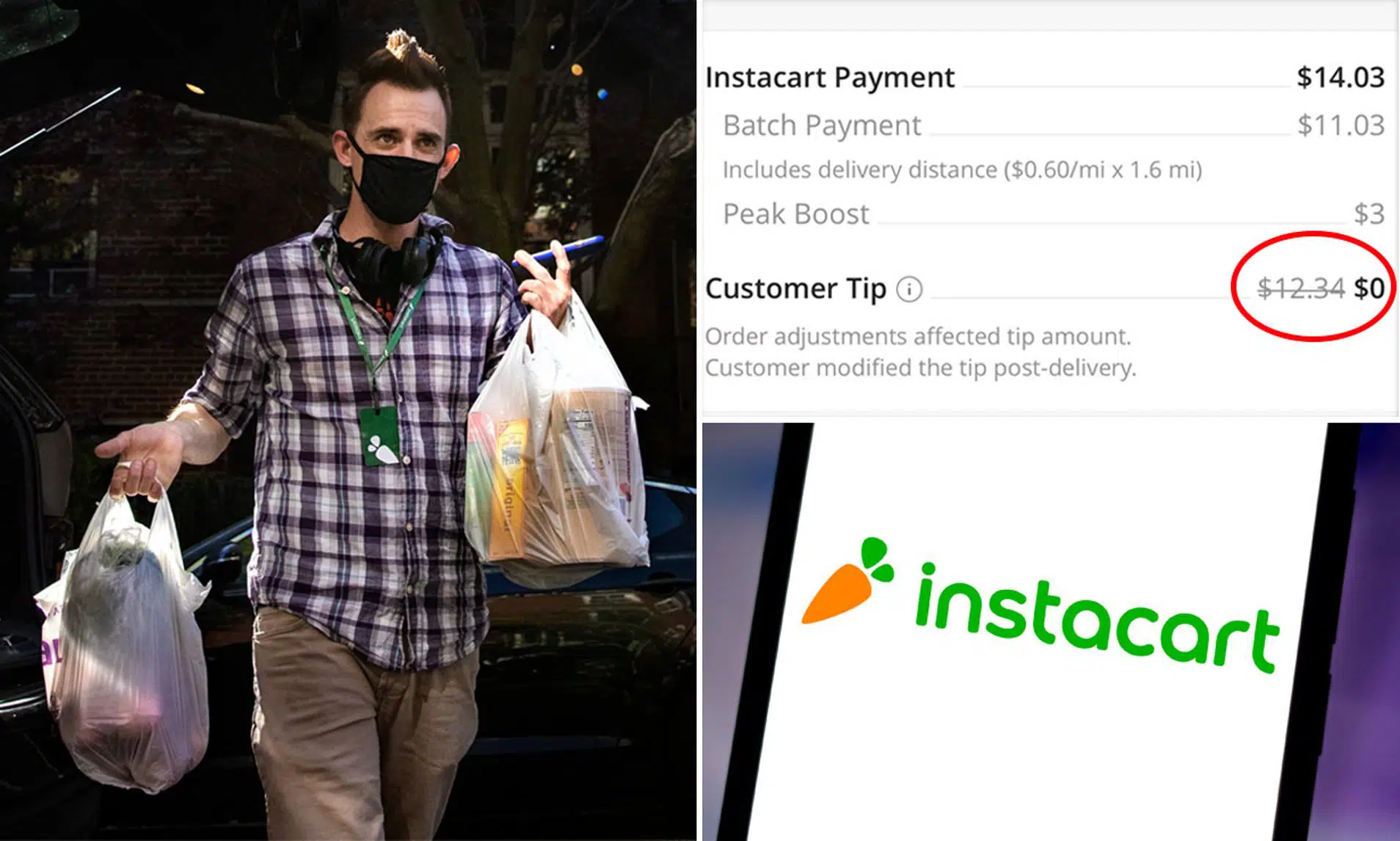

Instacart Tipping Etiquette How Much Am I Supposed To Tip

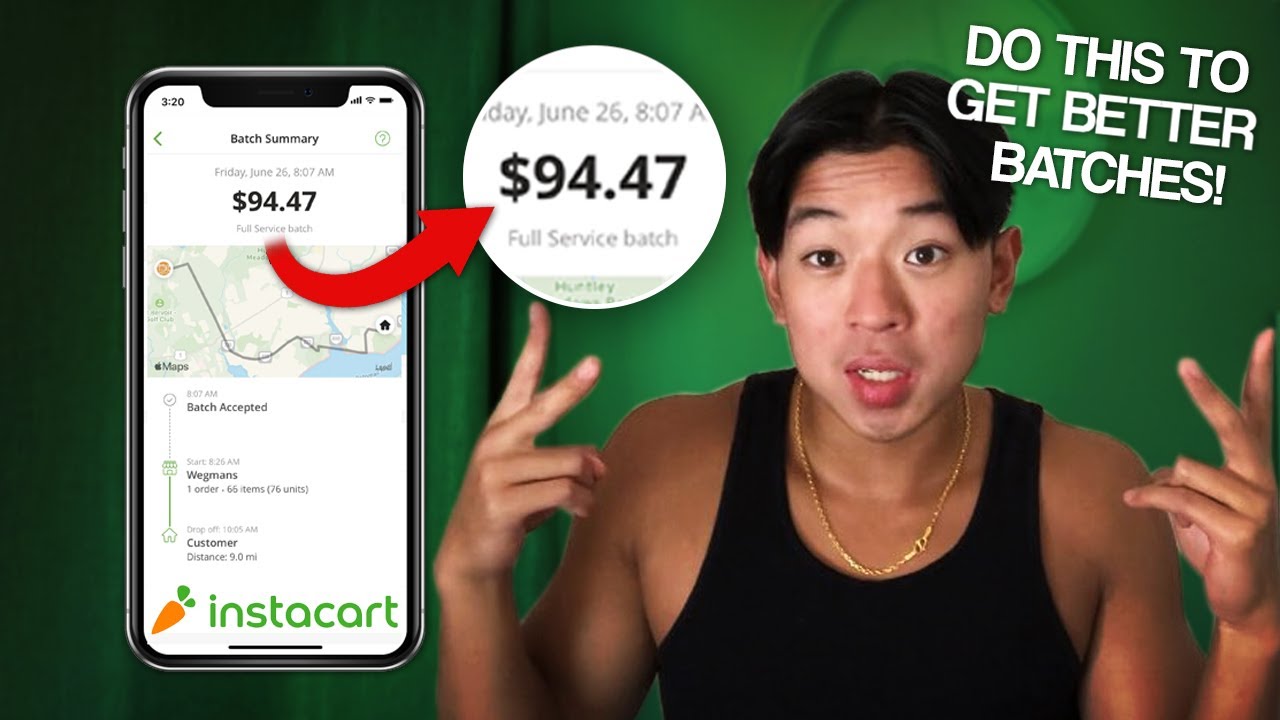

How To Get The Best Instacart Batches Do These 3 Things To Get Paid More Youtube

Instacart Q A 2020 Taxes Tips And More Youtube

What Is A Gst Hst Number Canada Only Instacart Onboarding

Instacart Unveils New Driver Safety Measures Pymnts Com

Instacart Reviews 1 991 Reviews Of Instacart Com Sitejabber

Instacart Driver Jobs In Canada What You Need To Know To Get Started

What You Need To Know About Instacart Taxes Net Pay Advance

Shopper Delivery Driver Thank You Card Sticker Thank You Note Etsy Business Card Displays Custom Business Cards Grocery Shopper

How To Download And Use Instacart Shopper App Login Info

2021 Tax Planning Avoiding Capital Gains Tax In Retirement With Taxcaster Capital Gains Tax How To Plan Capital Gain